The minister and his wife were on the verge of panic.

The weight of seemingly insurmountable debt was crushing them and their marriage. They had maxed-out credit cards with interest rates above 20 percent, which they had used to pay off basic necessities as well as some purchases they were now second-guessing.

They found themselves ignoring letters from creditors. Opening them just added to their shame—which they hadn’t admitted to anyone, certainly not the church he pastored.

They began blaming each other. “Sometimes I felt like it would have been easier to be an alcoholic—and have to confess that—than share that we were so deeply in debt,” he says. “Every week, I felt like a fraud and a failure because I knew I wasn’t giving my full attention to the church. I couldn’t concentrate. My wife and I were fighting all the time, but then I would go and do marriage counseling for others. I started resenting the church, thinking that if they just paid me more, we wouldn’t be in this mess. While there was some truth to that, it wasn’t the whole story, and I hated to admit that I didn’t handle money very well.” The couple felt little hope.

Then they discovered the Covenant Financial Leadership Initiative (CFLI).

The initiative, funded by a $2 million Lilly Endowment grant, is available to Covenant pastors, missionaries, and chaplains. It includes four key components: financial workshops, financial assistance grants up to $10,000 to help with debt, personalized financial coaching, and congregational workshops focusing on financial practices and developing cultures of generosity.

“We felt like we were in financial stress we never would be able to untangle from,” one participant said. “Financial Leadership came alongside us and showed us a path of hope. The program was a catalyst to blessing. Today we are in a much better place to serve our community.”

Recipients of grant assistance must agree to participate in a financial Jump Start retreat, which helps assess current financial health, identifies personal money beliefs and how they impact financial choices, and helps develop an action plan that includes a budget and debt reduction strategies.

Those who aren’t struggling with debt but want to increase their financial knowledge and receive personal coaching can also participate. About one-third of total participants take advantage of the Jump Start training and coaching without receiving financial assistance, says Marti Burger, director of vocational innovation for Develop Leaders.

Once an individual or couple completes Jump Start, they apply for coaching assistance, which includes up to four sessions with a trained financial coach. “Participants can request a particular coach from our roster, or we will assign one we believe will be a good match based on the participants’ needs and the expertise of the coach,” says Don Meyer, coaching coordinator.

An all-day Saturday training seminar is available to pastors and church treasurers and leaders, offered by National Covenant Properties. The free seminar provides tools to help churches deliver good financial reporting, build healthy financial practices, better manage risk, and understand a broad range of essential topics, from ministerial compensation to fraud protection.

The initiative also brings together regional groups of local church leadership teams that meet over the course of eight months. It can provide seed money to serve as a match catalyst for under-resourced churches to contribute to their minister’s pension account.

Although CFLI encompasses a wide range of benefits, the primary focus of the initiative remains on pastoral financial wellness.

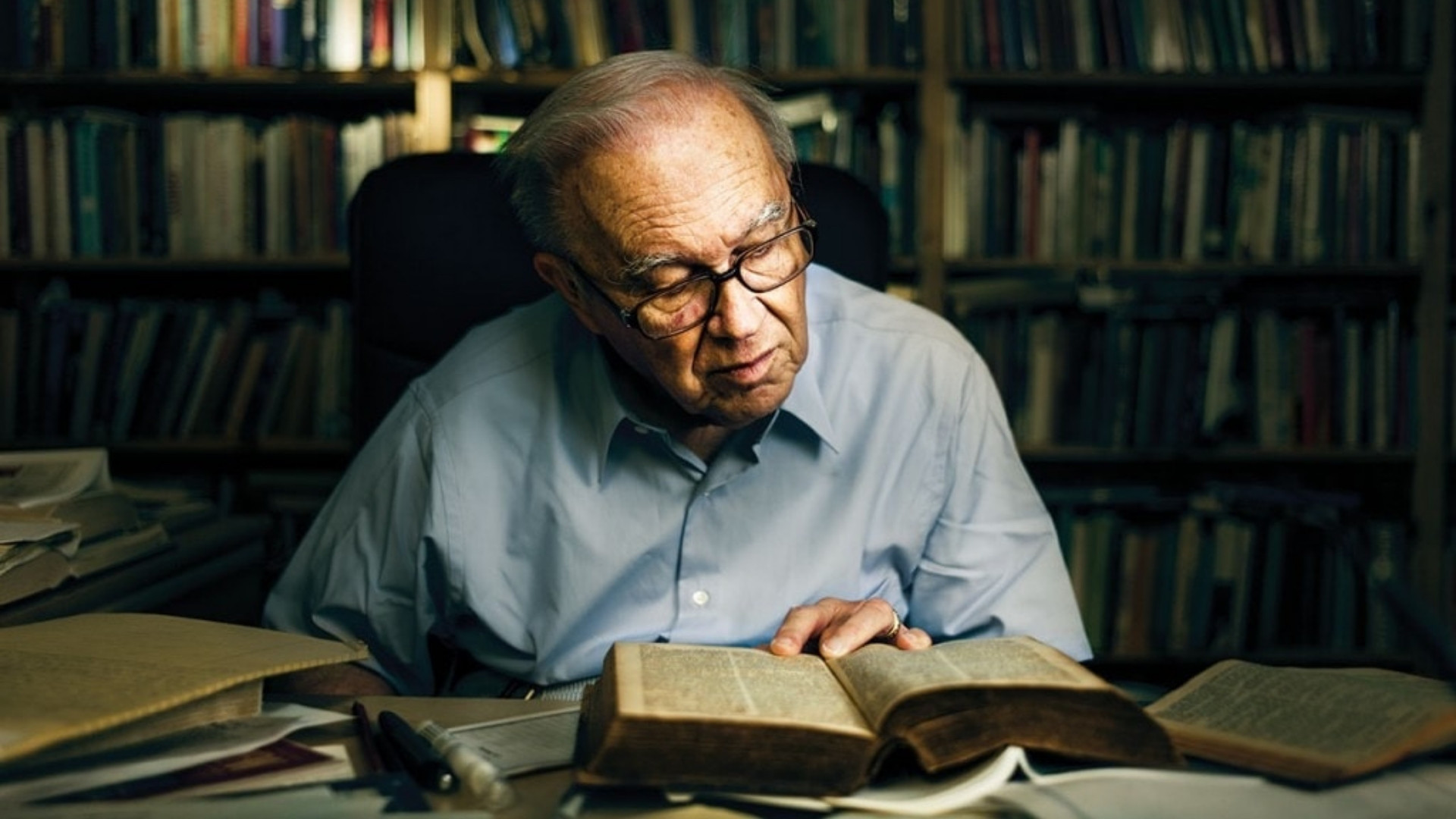

“It is designed to remove the shame people have over finances and set them on a path to financial wellness,” says Herb Frost, director of vocational and spiritual development in Develop Leaders. “Even people who have made good decisions can find themselves in financial distress, but in our culture, financial success is often equated with being a good human being. Pastors often don’t earn enough for those consolations.”

Frost adds, “The culture creates an expectation that a pastor should be an expert in all things in life. So, part of this initiative is destigmatizing the issue for pastors so they can go into the future better equipped spiritually and financially. They’re also better equipped to lead their congregations in the next step of developing congregations in areas of generosity and expanding their own financial acuity.”

More than 30 couples participated in the most recent retreats. Although the retreats were held online due to Covid-19 restrictions, they still were a great success, says Burger.

“Offering Jump Start virtually has provided opportunities to connect pastors from around the country and globally with financial leadership resources,” Burger says. “Because of our partnership with Lilly, we can provide Consumer Aid grants for debt repayment for school loans, medical bills, and consumer debt. In 2020, we awarded more than $100,000 in aid to our pastoral community.”

The success of the initiative has created a challenge in finding enough volunteer coaches. Coaches agree to work with up to four couples or individuals over the course of a year. As the number of Jump Start graduates grows, the need for coaches will increase.

Volunteer coaches come from a variety of backgrounds and work experiences with a healthy understanding of financial basics, Meyer says. Coaches receive training that is paid for by CFLI.

“Coaches do not provide financial advice,” he says. “Rather, they are trained to come alongside and help clergy and spouses clarify their challenges and develop their own solutions.”

“If you tell someone what to do, it may work for a little while, but it’s more likely that they’ll stick with it if they come up with the idea themselves,” says Paris Cager, who has coached several participants. “I feel like in this space I give them freedom not to be the pastor in the room. They just get to be people. I’m making a phone call—not because I need something—I’m calling to check in to see how they’re doing.”

Coaching has been a rewarding experience, Cager says. “Most people are very self-critical when they start. They’re just exhausted. They’ve tried a number of things, and nothing’s working. Most people feel they have fewer skills than they actually do.”

She adds, “In four months, you don’t see all the change, but you see the momentum. People feel like they can do this, and they’re excited to tell about their progress.”

Covenant pastor Chris Breuninger recently coached for the first time. “If you have listening skills and basic financial literacy, you could be a huge help to pastors,” he says. “Personal finance is not typically a strength of many pastors. Combined with their relatively low pay, this creates a burden of stress, as if their burden wasn’t enough. It’s gratifying for me to offer coaching and to see burdens lifted.”

Anyone interested in becoming a volunteer financial coach can email Don Meyer at covcoaches@gmail.com or Marti Burger at marti.burger@covchurch.org